Oops, we did it again...

The Markets Bought the Narrative. The Numbers Say They Were Misled.

What if the story we were told about the job market was completely wrong? Not slightly off. Not a rounding error. But nearly 300,000 jobs off.

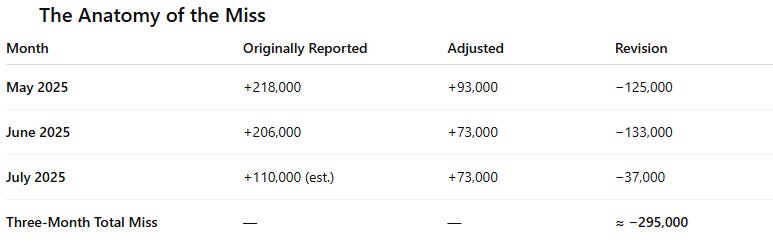

The July 2025 jobs report didn’t just disappoint. It detonated. The economy was expected to add 110,000 jobs. It managed only 73,000. But that was just the start. In a quiet footnote, the Bureau of Labor Statistics revised May and June’s job growth down by 258,000, a gut punch to the illusion of a resilient labor market.

In minutes, three months of perceived growth dissolved into contraction. Markets had rallied, headlines had praised, and policies had leaned on this “strength.” It turned out the entire premise was flawed.

Worse, no credible explanation has been offered. No war, no pandemic, no data glitch. Just a clean revision that gutted the previous narrative, and followed swiftly by Trump firing the head of the BLS and accusing her of sabotage.

If this were the only instance, it might be chalked up to bad luck. But it's not. This kind of distortion fits a long pattern.

During Trump’s first term, the White House routinely exaggerated economic performance. Job growth, GDP, trade wins, the impact of tax cuts, were all oversold. The data later told a different story. Promises of 5 to 6 percent GDP growth never materialized. Tariffs were sold as a burden to China, but Americans paid the cost. The 2017 tax cuts were pitched as a wage-boosting engine, yet wages barely budged while deficits ballooned.

Now in his second term, that same playbook is back, and with the most trusted numbers in the economy being quietly rewritten in the shadows.

This isn’t just a statistical error. It’s a case study in manufactured perception. And if nearly 300,000 jobs can vanish without accountability, what else is being revised behind the curtain?

The Anatomy of the Miss

To understand the scale of what happened, we need to revisit the last three U.S. jobs reports. At first glance, they painted a picture of a labor market that was cooling but still resilient. That picture has since fallen apart.

Here’s how the data unfolded:

Total deviation: approximately 295,000 jobs.

These aren’t minor revisions. They are sharp turns in the economic narrative. Numbers like these shift how the Federal Reserve thinks about rates. They influence whether companies hire or freeze. They shape how the public perceives the health of the economy.

Yet these major changes arrived quietly. No major press conference. No real-time alarm. Just a revision, weeks after the original headlines had already shaped the narrative.

What looked like strength now resembles something much closer to stagnation, or something deliberately misrepresented.

Has This Happened Before?

Yes, but only during extraordinary crises:

Great Depression (1930s): Employment collapsed from ~3% unemployment to ~25%.

WWII Demobilization (1945): ~3.7 million jobs fell over a chaotic transition.

Oil Shock & Stagflation (1974–75): ~2.3 million jobs lost in abrupt contraction.

Double Dip Recession (1981–82): ~2.9 million job losses amid rapid Fed tightening.

Great Recession (2008): BLS later revised down payrolls by ~2.3 million.

COVID-19 Crash & Recovery (2020–21): March losses doubled upon revision; 2021 hires later revised up by nearly 2 million.

2023 Benchmark Revision: The BLS adjusted down March 2023 job count by ~306,000.

What they all share: massive external shocks triggered the labor market swings. Crucially, most large revisions occurred retroactively through annual benchmarking, and not as real‑time corrections two months after publication.

“Oops” Doesn’t Quite Cut It

To put this in perspective, we are witnessing the largest real-time quarterly downward revision of nonfarm payrolls outside of crisis periods in modern U.S. economic history.

So we’re left with an uncomfortable reality: either the labor market has become fundamentally harder to measure without precedent, or the official numbers we’re receiving are being manipulated in ways that market participants are right to question.

Again, unlike every prior case, mid‑2025 reflected no crisis:

No recession.

No pandemic.

No war, OPEC shock, or financial contagion.

Instead, what was revised away was perceived growth, not sensational volatility. The labor market appeared intact—until it didn’t.

📣 Economist & Market Reaction

“It’s worse than anyone expected … that figure going from 147,000 to just 14,000 … it’s frankly pretty shocking.”

— Helen Given, Monex trading lead, reacting to the negative revisions.“The July report officially confirms the labor market has kicked into a lower gear … Investors will need to recalibrate their views … given the headwinds.”

— Jeff Schulze, ClearBridge Investments Reuters

Official Explanations, Unofficial Doubts

Some defenders of the current system argue this is just what happens at economic turning points. Others say the BLS is a nonpartisan institution that simply updates its data as better info comes in.

But both defenses strain under the weight of this data:

If this is a turning point, then why did BLS miss three months in a row, all in the same direction? That’s not random error, that’s a pattern.

If revisions are based on better data, then why are these large shifts always delayed until markets have priced in the rosier outlook?

And while the BLS may indeed be independent, its inputs are not immune to political interpretation or timing. Private survey data, state reports, and model assumptions all feed the sausage grinder. When a politically beneficial story emerges—and then vanishes retroactively—that’s not just unfortunate. That’s suspect.

A “Non‑Explanation” Economy

There may be innocent reasons why job numbers go off track—seasonal adjustments, low survey response rates, and quirky modeling are well-known hazards in real-time macro data. But in 2025, these usual explanations strain under the weight of economic reality.

When the administration and media pushed forward with stories of continued strength, markets listened. Analysts, traders, and policymakers priced in a resilient labor trend, until the truth quietly emerged two months later.

Here’s how Wall Street reacted when the revisions came down:

The Dow Jones Industrial Average dropped approximately 542 points, or ‑1.2%

The S&P 500 declined about 1.6%, marking its fourth straight day in the red

The Nasdaq tumbled 2.2%, notably worst racking week since mid-May

Banishing illusions of calm, this sell-off reflected newfound fears around slowing growth and renewed tariff uncertainty.

Meanwhile, bond markets reacted with caution: 2‑year Treasury yields fell by about 25 basis points, signaling a rush toward safe assets and growing expectations of a Fed rate cut soon MarketWatch.

Markets weren’t just disappointed, they were rattled. Corporate leadership revised hiring guidance downward, and investors recalibrated growth expectations in real time.

At best, this reflects staggering incompetence in measurement and communication. At worst, it hints at something more coordinated: a data‑driven mirage deployed during a politically charged moment.

Either way, the casualty isn’t just lost jobs, it’s fractured trust.

The Cost of Cooked Numbers

Trust in official statistics underlies every economic decision, from Fed policy to corporate hiring to political debate. When a high‑profile data release is later revised so dramatically, in the absence of catastrophic change, confidence erodes.

The Q2 2025 jobs revision isn’t just a statistical glitch, it’s a test case for the credibility of our data institutions during politically turbulent times.

What needs to happen:

Detailed transparency from BLS on what drove the revisions.

Independent review or audit of methodology to ensure it wasn’t compromised.

Watchfulness in future jobs reports, because if 258K jobs can disappear on paper, anything might.

Source List

News & Commentary

U.S. labor market cracks widen as job growth hits stall speed, Reuters (July 31 / Aug 1 2025) – covers 73k July payroll gain and 258k downward revisions to May–June data. The Times of India+10Reuters+10Wall Street Journal+10

U.S. Hiring Slowed Sharply Over the Summer, Wall Street Journal (Aug 1, 2025) – sectoral breakdown and policy context. Wall Street Journal

Trump fires labor statistics chief after large revision to jobs report, Washington Post (Aug 1 2025) – firing of BLS Commissioner and political reaction. Bureau of Labor Statistics+15The Washington Post+15The Washington Post+15

Disappointing Jobs Report Leaves Fox Business Panel ‘Stunned’, The Daily Beast (Aug 1 2025) – immediate market panics and analyst quotes. The Daily Beast

Axios: Amid Trump orders to fire BLS commissioner, here's why jobs data revisions happen – explanatory process of BLS revisions and context. Engineering News-Record+2Axios+2Axios+2

Explanatory & Background

Labor Market Loses Momentum: July Adds 73K, Prior Months Slashed by 258K (Engineering News‑Record) – payroll and revision specifics. Reuters+5Engineering News-Record+5Fortune+5

The bleak economic picture emerging from the jobs numbers, Washington Post opinion (Aug 1, 2025) – perspective piece on political impact. The Washington Post+2The Washington Post+2The Washington Post+2

Opinion: Trump should heed, not hide, the jobs numbers, Washington Post (Aug 2, 2025) – political commentary on firing of BLS leadership. The Washington Post