It Took Trump Seven Weeks to Tank the Economy

How a booming economy collapsed under reckless policies and chaotic leadership.

It took Donald Trump a mere seven weeks to derail the American economy and send the country hurtling toward recession. Seven weeks. That’s all it took.

Despite his desperate attempts to convince his base that he inherited a disaster, the economic facts say otherwise. By every traditional measure of economic health, the U.S. economy was in solid shape when he took office.

The Economy Trump Actually Inherited

Trump has once again been conditioning his base to believe that he inherited a failing economy, deflecting blame for the declines caused by his own policies and chaotic leadership. Yet, the data tells a different story. Before Trump returned to the White House, here’s where the American economy stood at the end of 2024:

Gross Domestic Product (GDP): The economy was expanding, with real GDP growing at an annual rate of 2.8%—a healthy pace of steady economic activity.

Inflation: The Consumer Price Index (CPI) rose 2.9% for the year—moderate and manageable.

Unemployment: At 4.1%, the unemployment rate was slightly higher than earlier in 2024 but still historically low.

Stock Market: The S&P 500 closed at 5,881.63 on December 31, 2024, marking an impressive 23.3% increase for the year.

In other words, the economy was strong. There were no signs of imminent disaster. And yet, in just seven weeks, all of these numbers have tanked.

The Damage So Far: Trump’s Economic Fallout

Fast-forward to today, and the numbers tell a different story:

The S&P 500 closed at 5,614.62 today—the lowest it’s been since July 10, 2024. That’s a sharp decline in investor confidence.

GDP forecasts for 2025 have been slashed—Morgan Stanley now projects just 1.5% growth, down from an earlier estimate of 1.9%, citing concerns over tariffs and inflation.

Inflation expectations are worsening—Americans now anticipate a 3.1% inflation rate for the next year, up from 3.0% in January.

Job growth is slowing—Projections indicate that only 100,000 jobs will be added per month, and unemployment is expected to rise toward 4.4%.

The CPI is signaling trouble—Consumers are becoming increasingly concerned about rising unemployment and restricted credit access.

The stock market is in turmoil—The S&P 500 has lost 6% in just the past month, driven by fears over economic stagnation and chaotic tariff policies.

America: The Worst-Performing Stock Market in the World

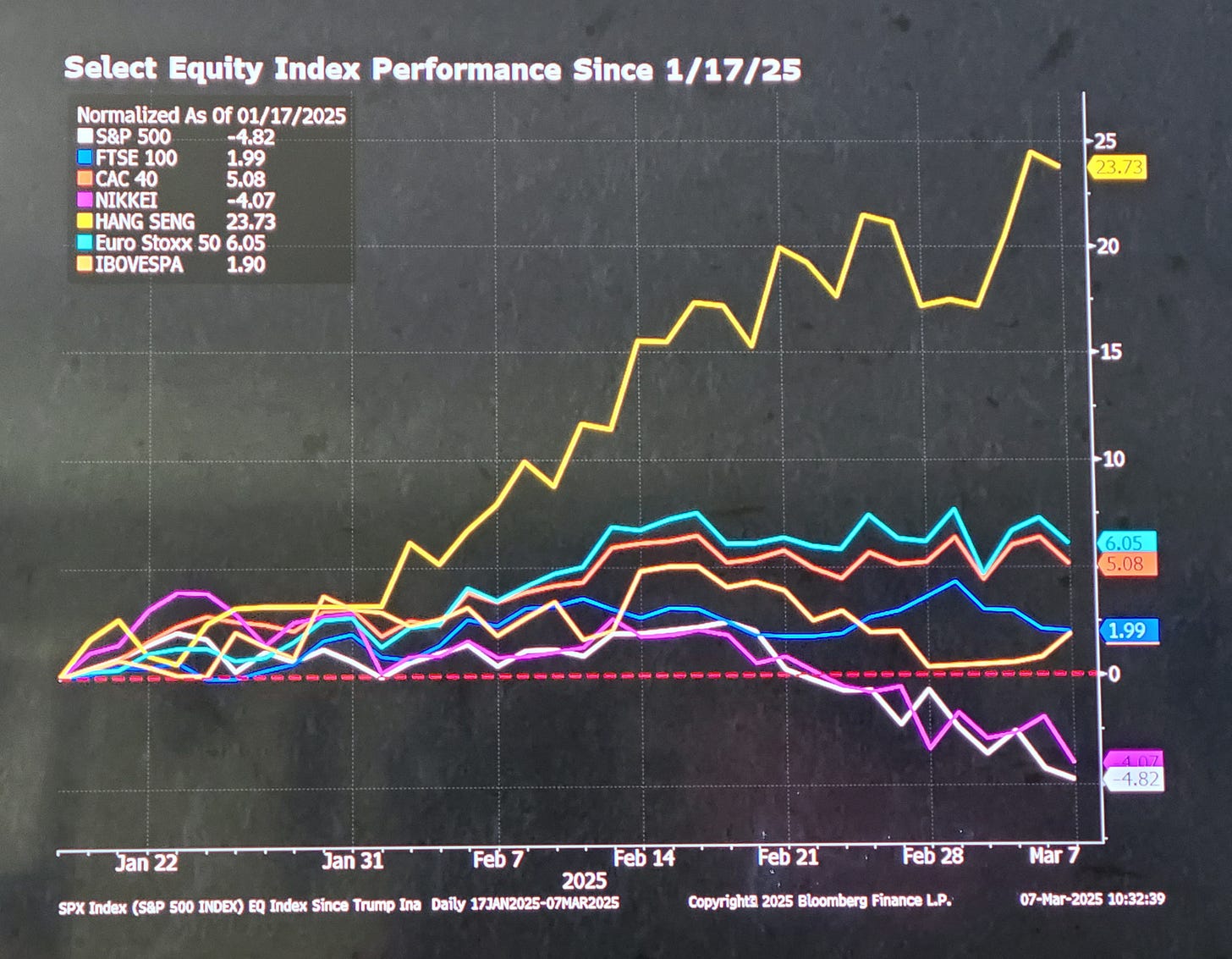

The chart below paints a stark picture. The white line represents the American S&P 500 index compared to other international stock indices. The U.S. market is currently the worst-performing in the world.

Contrast that with the best performing index over the last month. The Hang Seng Index:

S&P 500 this past month:

S&P 500 performance this past month: Declining steadily.

Hang Seng index this past month: Rising sharply.

Two economies, two trajectories. Investors are shifting their money out of the U.S. and into Asian markets, where valuations are lower and growth prospects are better. Why? Because Trump’s reckless trade policies—especially his erratic tariffs—have spooked businesses and investors, raising the risk of recession and making American equities less attractive.

The Cost of Ignorance

This is what happens when you elect a president with narcissistic personality disorder who refuses to read. Trump isn’t just uninformed—he’s actively hostile to knowledge, convinced that his instincts trump economic reality. Unfortunately, the markets, investors, and everyday Americans are paying the price for his incompetence.

Seven weeks in, and the warning signs of a self-inflicted economic downturn are flashing bright red. The question now is: how much worse will it get?

Sources:

GDP Growth (2024 End):

https://apnews.com/article/86a09ee9948419d066c4b39959e32cd3Inflation Rate (End of 2024):

https://www.bls.gov/opub/ted/2025/consumer-price-index-2024-in-review.htmUnemployment Rate (End of 2024):

https://apnews.com/article/86a09ee9948419d066c4b39959e32cd3Stock Market (S&P 500 Closing in 2024):

https://apnews.com/article/5ad7143c471fbb104ad946b2113f0d742025 GDP Forecasts & Downward Revisions:

https://www.reuters.com/markets/us/morgan-stanley-cuts-us-growth-forecast-2025-tariff-concerns-2025-03-07Inflation Expectations (March 2025):

https://www.reuters.com/markets/us/ny-fed-worry-over-outlook-increases-amid-stable-inflation-expectations-2025-03-10Employment Forecast for 2025:

https://www.ey.com/en_us/insights/strategy/macroeconomics/us-economic-outlookStock Market Decline (March 2025):

https://www.marketwatch.com/story/stocks-sell-off-on-growth-scare-yet-companies-talk-of-recession-is-lowest-since-2018-698048a9Investors Moving from U.S. to Asian Markets:

https://www.reuters.com/markets/rotation-toward-asian-equities-is-just-getting-started-raychaudhuri-2025-02-20

I'd be willing to bet the ketamine-fueled jester is still cackling away though